Bonjour lecteurs! Are you planning to spend Christmas abroad this year? Or are you booking a trip overseas next month to fight the January blues? We are off to France and I am so excited as it is the first time we will spend Noël there in 4 years. But with the rising cost of living, we will reduce our expenses like many other Brits. Here are my top Frenchie idées To Keep Costs Down Abroad. Here is what I do with our travel money outside the UK.

Book Early

Book your tickets as soon as possible.

Last-minute offers are rarely cheaper, and you will find that the more organised you are, the better deals you will get.

It’s also worth using comparison apps and websites for the best deals.

Do the same with your accommodation. You can get great deals if you book months ahead.

Work Out A Spending Budget

… And stick to it!

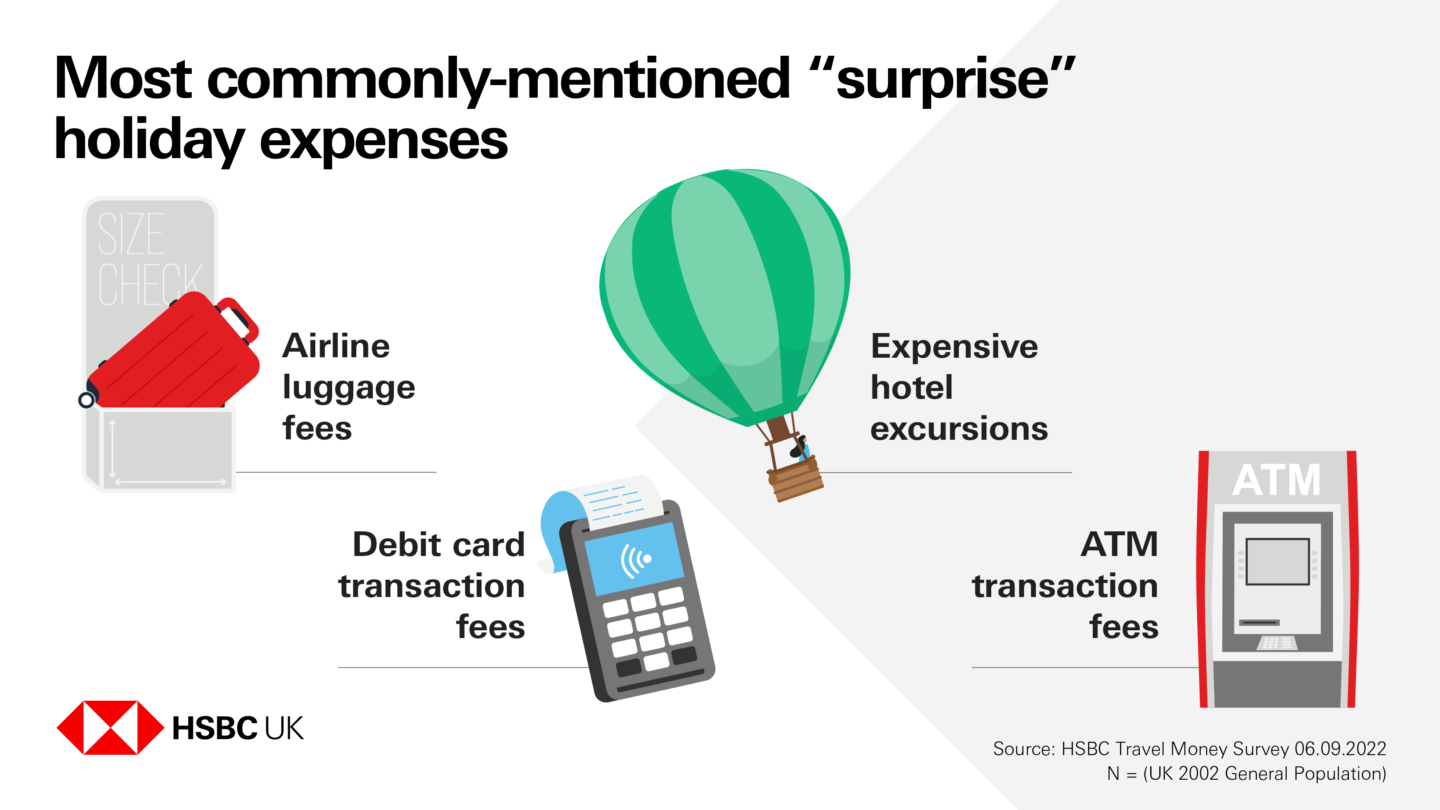

Easier said than done? I know the feeling! We always end up spending more, so I always prepare an extra 10% in cash just in case.

They are always some extra costs. Par exemple, the last time we went to France, we ended up paying more than expected on the toll roads.

And we had a few impromptu expenses, especially buying some yummy food like brioches 🤣

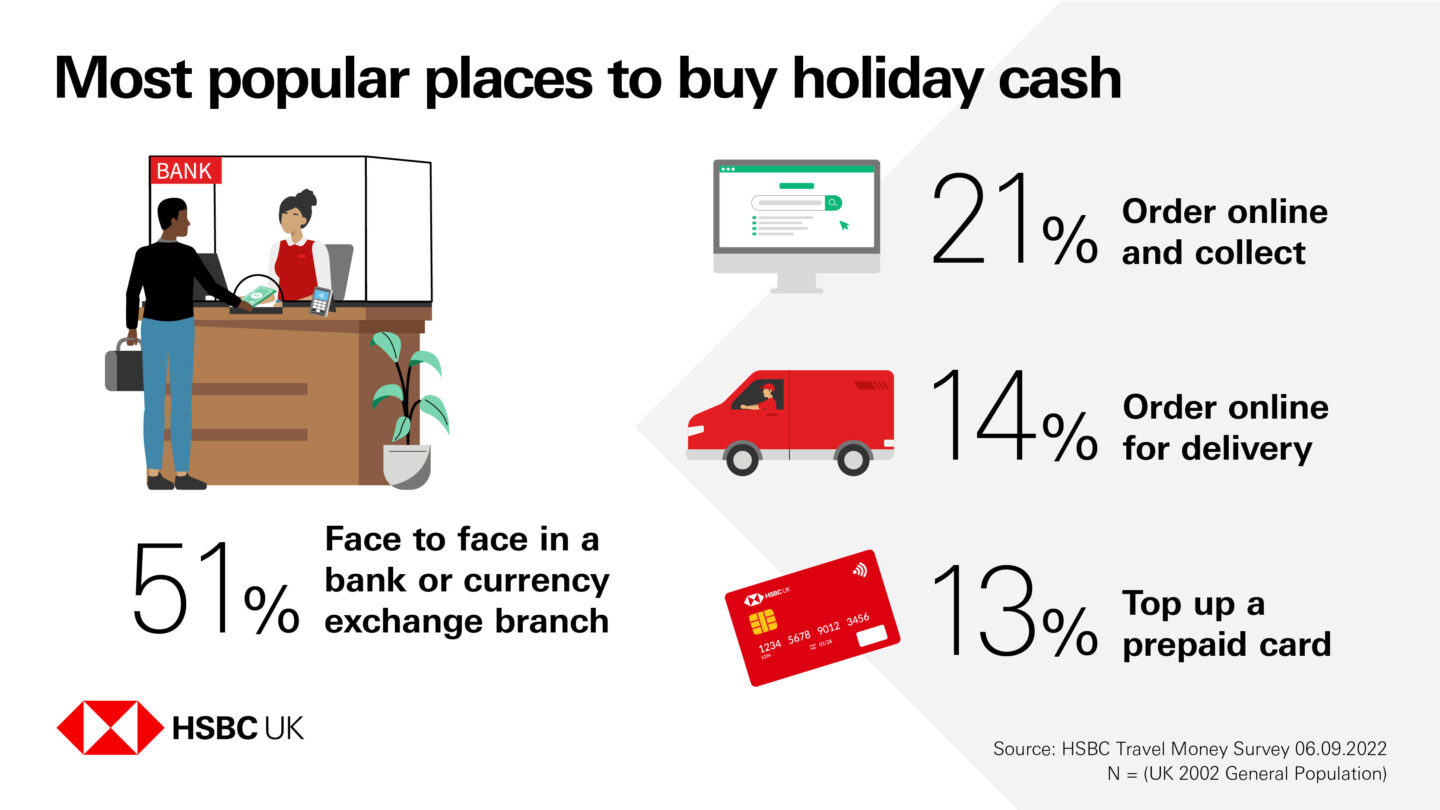

Buy Your Travel Money Before You Travel

Don’t wait to be at the airport to get some local money. The rates are always so high.

It can be much more expensive than getting it in advance. And if you buy at a time when the exchange rate is favourable, you get more spare money to spend!

Know Well Charges

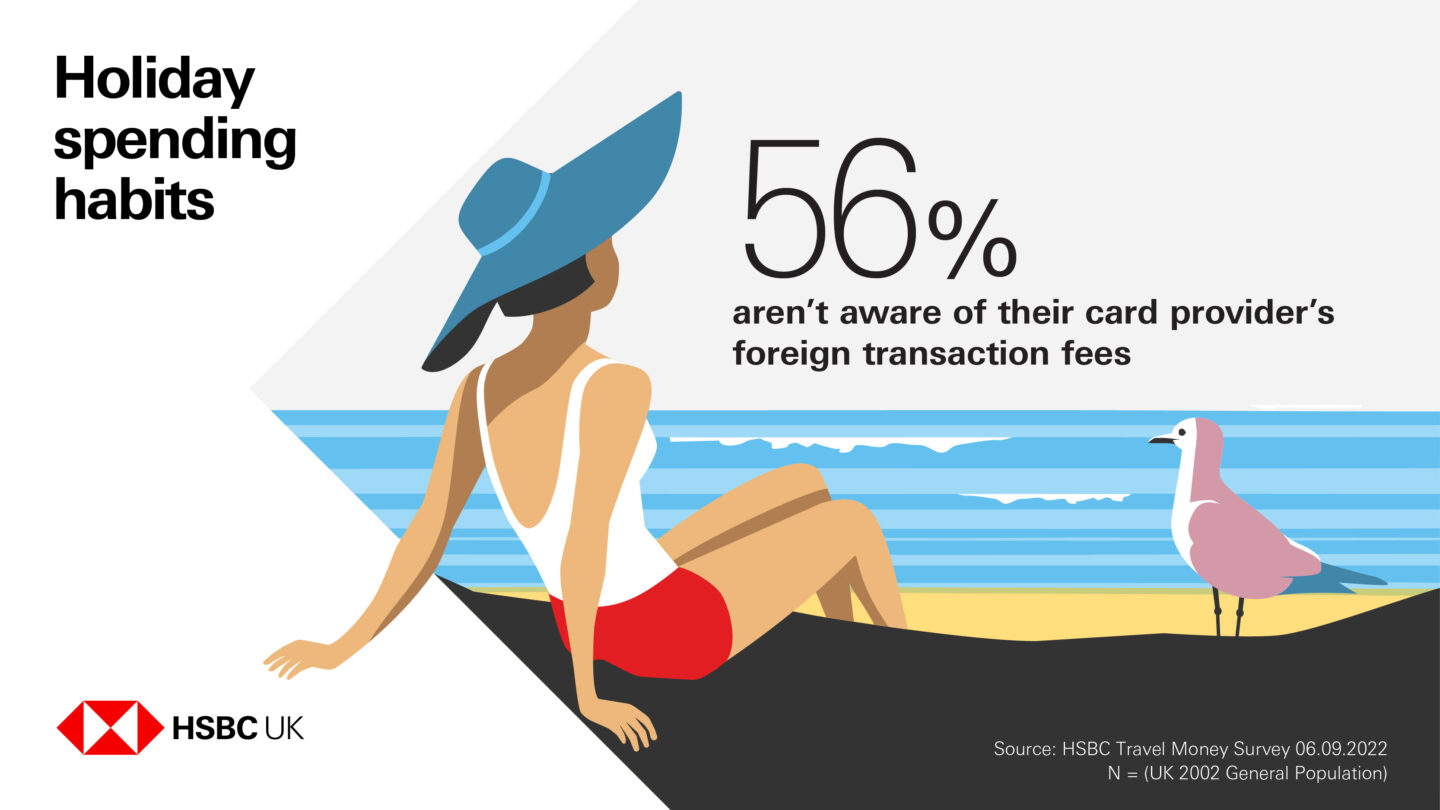

It’s also worth checking en détails with your bank what kind of charges you would expect, depending on your destination.

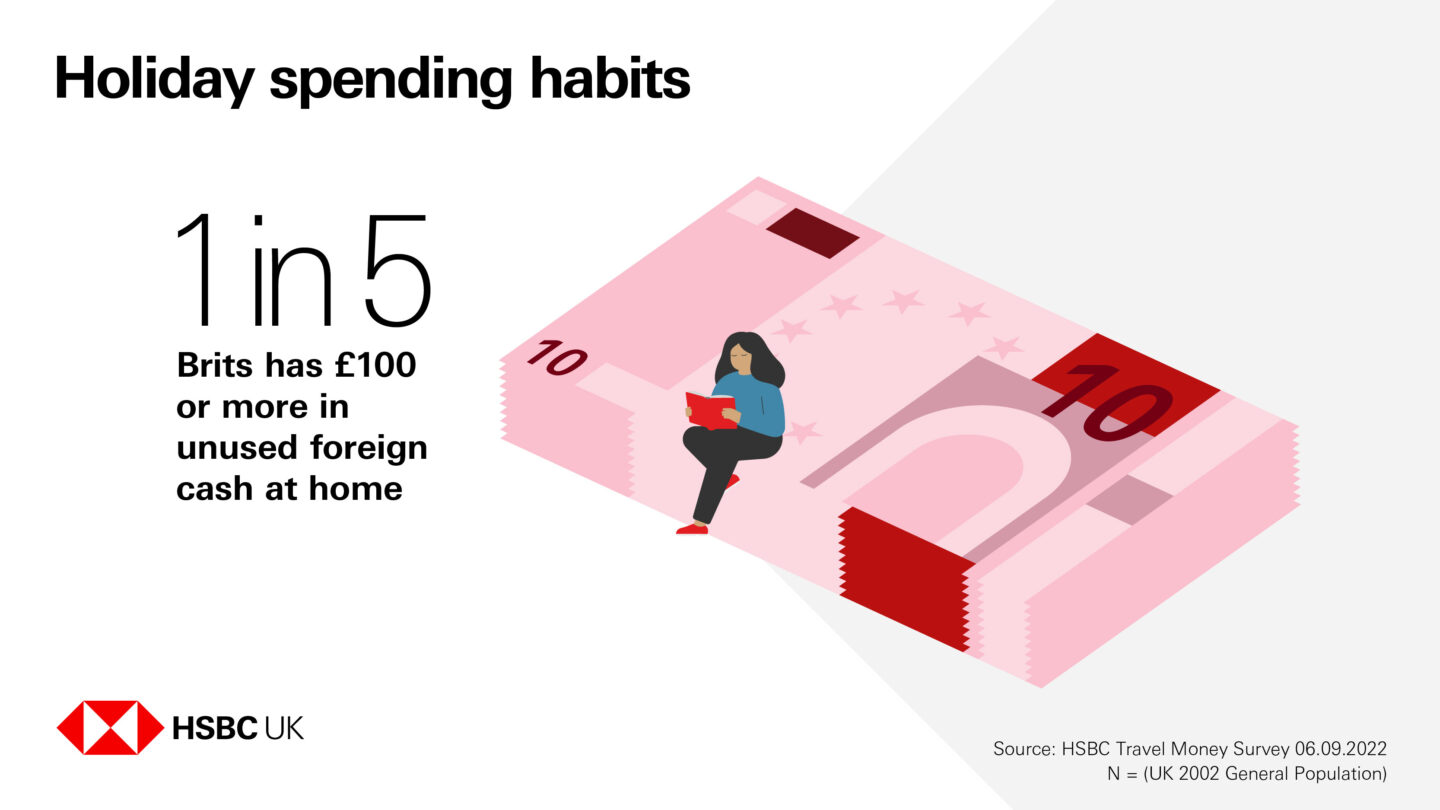

A recent survey by HSBC found out that more than half of travelers don’t know how much their debit card provider charges for purchases or cash withdrawals!

It’s only a few clicks away or a quick phone call.

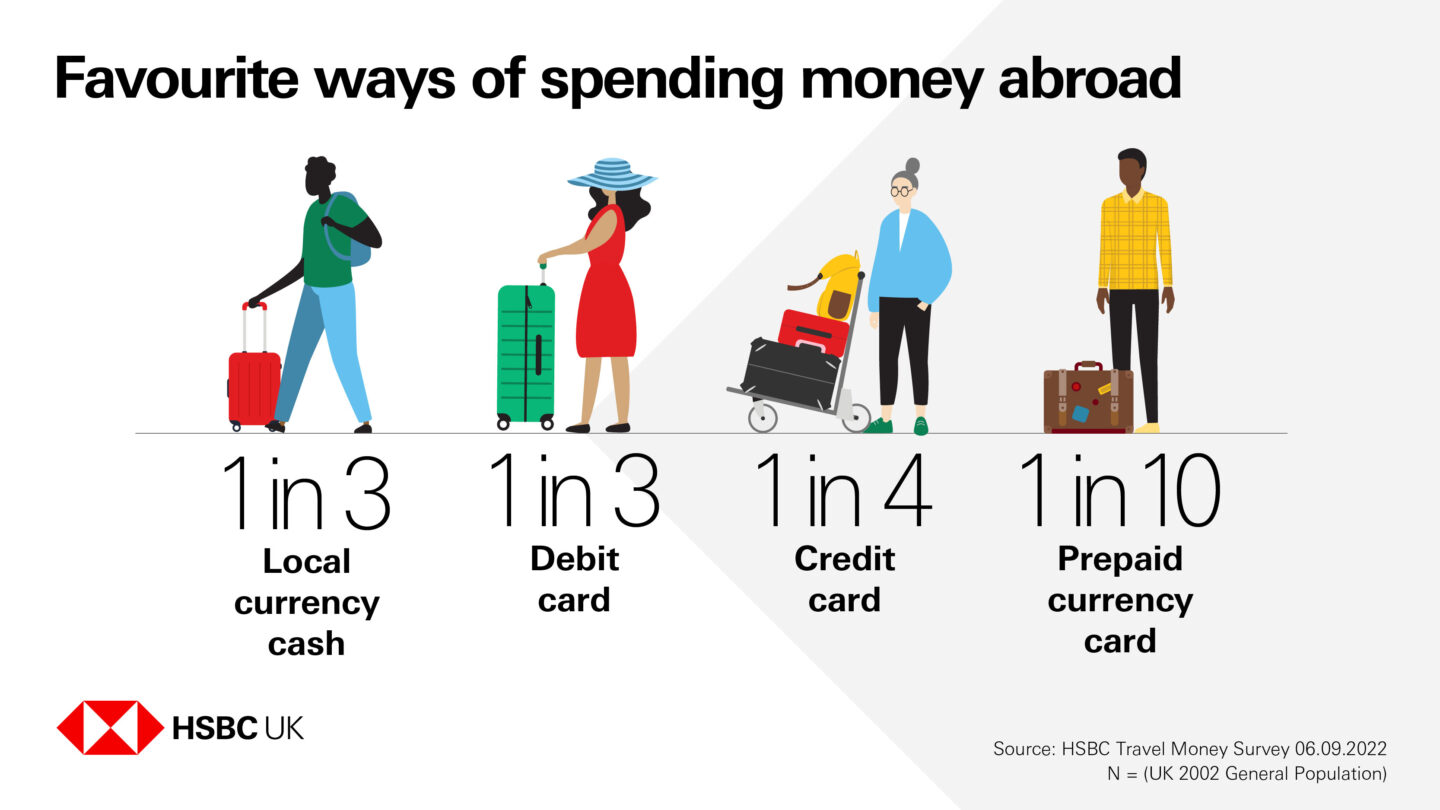

Pay Cash in The Local Currency

I know nowadays, we are getting more and more into a cash-free society.

But je préfère having some holiday cash. There is always some extra cost you might not have thought of.

And this way, I find it easier to stick to my budget.

It’s also worth paying in the local currency rather than in GBP. This way, you’ll get the most up-to-date exchange rates and avoid conversion fees.

Withdrawals Abroad

I only withdraw money abroad if I really need it.

There is always some extra cost. And the branch you are withdrawing money from might charge an additional fee on top of the conversion rate. Not cool!

And this way, you also avoid bringing leftover cash home with you.

Finally…

Don’t forget to let your bank updated with your plans. So that if anything happens to your card, you are covered.

We also have holiday insurance so that we are covered just in case of a bad surprise.

Usually, I try to just pay all my expenses with cash, but if I need some extra, I always have my debit card as a last resort.

What do you think? Do you prefer using your debit card or travel money when you are outside the UK?

What are your traveling plans for next year? Have you already booked something? Cash or card?

I can’t wait for a Frenchie Christmas with my famille!

Disclosure: This is a sponsored post in collaboration with HSBC.

Excellent – charges can be avoided

Keeping within budget with a little know how

After reading your article I realised that I am unaware of how much my debit card provider charges for purchases or cash withdrawals! I will check it out next time before we go!

Sometimes a little research can help you save a lot. We always try and book early and use comparison websites to find the cheapest hotels and flights. We also use Chase to avoid withdrawal fees and spending fees abroad but it’s always wise to have their currency in cash. Also highly recommend cash back websites for when you book your holiday to get some money back

Author

I never used cash back websites, what a good idea! thanks for the tip!

You can get a lot of cashback especially when you’re spending over a thousand pounds.

In the old days we used travellers cheques, not sure they even exist anymore? I always use cash abroad to save credit card charges

Hopefully get a holiday abroad in 2023

This is really helpful. We are finally going away – to France! – next year. Our first trip abroad with our children, so we are definitely going to need more money than when we’ve travelled alone!

Lots of great tips!

Very helpful for those who go abroad. I never do, but for those who do this would be helpful I’m sure ♥

An interesting blog and very useful. I’m not going abroad until later next year, but great tips to bear in mind

So many helpful tips. Thank you.

This is great, can’t wait to go holiday abroad!

We tend to use cash but know which cards to use if nec.

Also helps to take snacks for the journey & if self catering, pasta & a concentrated sauce are always packed just in case of late arrival!

Author

That’s an excellent idea!

i think you have some really amazing and valuable tips in here it is amazing

using these for when I hopefully book New York!❤️

These are great tips. Especially as more places are becoming cashless it’s worth checking about the debit or credit card charges.

Great tips

There some great tips there

Great post, really useful for those going abroad and wanting to keep costs down

Great tips to help us save some money when travelling!

When I FINALLY get to go abroad again, there are some fantastic tips here to keep in mind

Some great inspiration as always

Great advice to use cash that way you can budget better. Also some cards don’t charge you to use them abroad check before you travel

I have a Santander Zero card which I specifically use for holidays as it doesn’t cost me any fees.

Some great tips thanks I like to use a pre loaded currency card when going abroad and also take a little local currency too, we are planning on a city break to Krakow this Spring and then lots of breaks and camping in the UK as we rehomed a dog in 2022 so lots more walking holidays for us rather than abroad

Great tips as you can really lose track of spending when abroad

Great honest tips

As always… Inspirational

Thank you for all this information it will really help when finally get on my next holiday