Bonjour lecteurs! Usually, it’s all about being a mum with young children. However, today, I will share with you some tips to help your kids with their student finances. The rising cost of living is having a huge impact on students nowadays. Better be prepared to handle student money worries ASAP. More than ever, our older children will need us. But how can we support them to have the best start in their adult life? Here are 8 Student Budget Hacks To Teach Your Children.

HSBC Students Survey

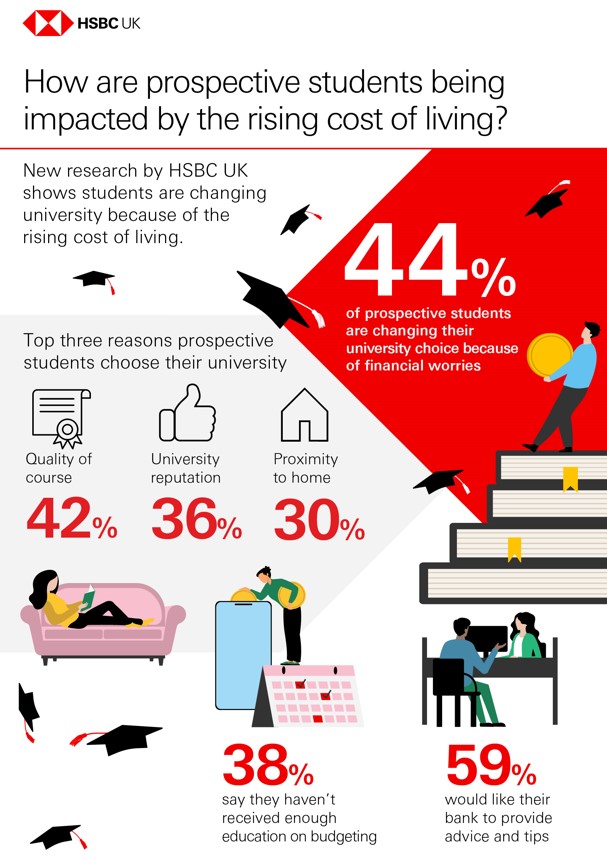

A recent Students Survey led by HSBC showed that British students are changing their habits because of the current economic situation.

It involves cutting back on spending and even borrowing more money to survive. Not a great way to start life with debts.

And it goes without talking about all the mental health issues it will certainly have on our younger generations.

Some have already changed their choice of university, studying closer to their family home so they don’t have to rent a place and save up on energy bills. So how can you help them? Here are my 8 Student Budget Hacks To Teach Your Children.

Before They Start University

Check tuition fees and save up as soon as possible. It will certainly get more and more expensive. If you can, open a saving account and put some money aside for you to help your child pay the fees when they are about to start l’université.

My parents opened up an account when I was a baby and put aside all the money I got every birthday and Christmas. It seemed tough at the time.

But once I was 18, I was glad to have a few thousand pounds to get started.

Work Out Your Budget

Just have an honest conversation and see how much you will be able to financially support them during their studies.

Work out your income. Is there any loan, bursaries, or grant they can apply to? Help them filling any forms.

Will they need to get a part-time job to complete your financial help?

Teach Them How To Budget

No more than ever, it is the parent’s job to give them a financial education.

Kids don’t have much education on how to budget, yet it’s such a vital skill in life!

Did you know that your children will build their money habits based on your own ones? Researches show that financial habits are usually formed in early childhood and can be tricky to undo.

Having a budget they need to stick to will provide them with a feeling of security. Better feeling in control.

Getting A Job From An Early Age

It’s never too early to get a job!

Encourage them from a young age to work. It could be something as simple as doing a paper round or any odd jobs in the neighborhood.

My dad helped me secure a place in a local bakery when I was barely 16.

Once I was in and proved I was hardworking, I would work there every single half-term and summer holiday until I was in my twenties. It really helped me to save up for my uni fees when I studied for my PGCE.

There are many job platforms like Jooble where you can check out jobs for teens.

Getting A Finance App

It might be worth downloading a finance app too. There are lots on the market.

Back in my days (feeling so old to write this!), I would only take cash with me when shopping. A classic trick in the books to not overspend.

But in an increasingly cashless society, that’s not always easy to do.

A good finance app can help them work out a budget in the first place. And many allow you to use that budget to put spending limits in place. They don’t get blocked if they go over it but they will get an automated nag. It’s as good as a nagging mum ?

Think Second Hand

From books to uniforms, think second-hand! It’s never been easier to buy online now.

Nowadays, I feel the younger generation is also keen to buy more sustainably.

Idem for clothes! There are so many vintage kilo sales around. I am personnellement a huge fan of Worth The Weight Kilo Sales.

And every time I go, I see so many students, grabbing some real fashion bargains. I also love Rumage for second-hand fashion, furniture, and more.

Or you can shop in charity shops. And the classic apps like Vinted.

Get your children used to the idée to sell their items too. I have used Facebook Marketplace with Stanley. So that we recycle and, he gets into the habit to pass it on when we don’t need an item anymore.

Buy Smart At The Supermarket

The HSBC survey showed that to cope with the rising costs, students have started to cut back by shopping at cheaper supermarkets (47%).

Simply remember to look at prices per volume! Not the good deals of the week! They often end up being more expensive and it’s pure marketing tactics to get you shopping more.

A good habit when shopping is to look at the price per liter or kilo. This way, it’s easier to work out the cheaper option.

Student Discounts

Student discounts are everywhere! Start by getting them a student card to prove their eligibility.

And tell your children to ask if a shop has a student discount when they get to the till. Even if it’s not advertised, they’ll often have a policy of giving 10% off to students.

The 16-25 railcard is un bon exemple. And now with the prices of petrol rising so badly, I reckon many students will use more often public transport to save up.

So here are my 8 Student Budget Hacks To Teach Your Children. C’est simple, yet effective and it will make such une différence in the long-term.

Let me know what other hacks you shared with your teens. Or even any good ones they found out themselves and taught you!?

I think it more expensive to be a student now than years ago when I was. Nowadays many students expect fast internet, TV facilities etc, and slso expensive phones on contract

Author

Yes I agree, Everything is way more expensive and it is going to be a challenge for everyone. Sadly, the university will increasingly become a luxury… So not for anyone anymore!

Really don’t mind second hand – a lot of great ideas for all

some great tips there, and not just for students, for us all trying to tighten our belts at the moment, thanks!

Good ideas!

I have a granddaughter in university at the moment and she will come out with a massive debt from her student loan. She also works as a cleaner to help to pay her rent and feed herself. She is used to hard work as has had various jobs from working in a ice cream parlour to helping in a hospital kitchen.

Great ideas, everything is so dam expensive these days

Secondhand is fine for most things but also potential students need to be able to cater for themselves both cheaply & nutritionally

My youngest granddaughter is in her 3rd year in University and to supplement her Student Loan she has a cleaning job in a hospital. She has worked since her mid teens and has done everything from working in an ice cream parlour to cleaning holiday cottages

Author

Good fro her! Hard-work is a good value to have.

Secondhand stuff & ability to create easy, cheap & nutritious dishes are a must when setting out for uni