Bonjour lecteurs! Another month and more targets to set up and achieve for me over the next term. One of my goals to reach this year is to set up a good pension to make sure that I am safe for the future. When it is about finances, I am usually very good and organised. As a teacher, I was putting aside money each month with my public pension. But since becoming self-employed last year, I must admit I left the matter on the side. You too? Or have you benefitted from an Automatic Enrolment? It could help your future! Let me tell you how!

Women More At Risk With Pensions

A Scottish Widows Women and Retirement Report launched last year showed some alarming stats regarding women and their pensions. For too many, sorting out a pension is clearly the last thing on their to-do list.

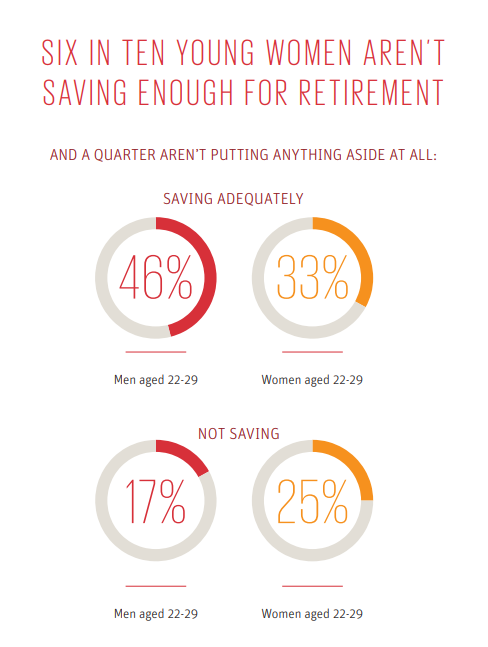

Women tend to save up less money for their old age early enough and therefore put themselves at risk for their future. La raison? Ladies aren’t planning their pensions early enough. In your twenties, you sometimes struggle to pay some rent and you want to establish your career. Let’s be honest, when you have un peu of money on the side, it goes into your hobbies.

My Story

Once you hit the thirties, time to be a maman. No clichés here, this is what I did. My Baba became my priorité. While I was still saving up for a pension, working part-time meant that I was putting aside less money.

This is simply why a third of young women are not saving adequately, compared to 46% of men their age! Oui, I know… Those stats are quite worrying, especially when we know that women tend to live longer and earn less…

Time to think about a pension!

Automatic Enrolment – C’est Quoi?

Auto-enrolment is simple. It is basically a Government initiative to help more people save for later life through a workplace pension. Any employee aged 22 up to state pension earning over £10 000 can automatically enrol into a workplace pension scheme and their employer contributes towards it too.

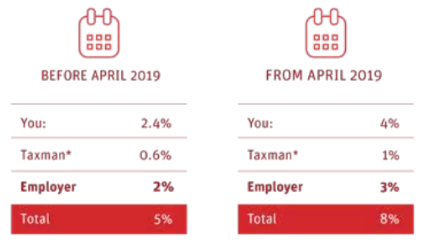

Workplace Pensions Minimum Contributions Increase in 2019

Good news ladies! The pensions minimum contributions are increasing this month. What does it mean for you? It basically helps you save more money for your future!

And the way it works is super simple. While you only pay 4%, you will actually put 8% towards your pension pot. Your employer and the taxman will put the other half.

In concrete numbers? It means that if you earn £27 000, you would only pay an extra £36 each month.

Some people would be tempted to opt out altogether as it doesn’t seem much. But looking at the figures I just shared above, it will make a difference to your future and help you to remain independent.

Is It Worth It For You?

I know far too well what ladies can face up when it is about saving for their retirement. Maternity leave, expensive childcare costs, reduced working hours once we return back to work. It can feel like a good option to opt out of auto-enrolment to save up or use this money for something else.

But the truth is that it could have serious implications for your financial future. So it is definitely worth considering re-enrolling now if you decided to leave.

Scottish Widows

Have a look now at the Scottish Widows website.

If you have any further questions on auto-enrolment and how it can work for you, it includes a lot of info.

Regardez the infographics available and see what little change like an extra £36 a month can make of a difference towards your pension.

There is even a calculator for you to test your personal situation and give you une idée of how much you should save up as a minimum each month.

If anyone knows it better, it is you! You are aware of the challenges of household budgeting and providing for your little ones. And you don’t want to ask for financial support to your children.

Because they will have their own concerns when they are grown ups 🙂

Pas de panique here, regardez this Mumsnet Live with Scottish Widows. It covers many questions about your pension and your future, mamas.

It is very helpful and makes things much clearer if you were unsure. But if you want more info, head over to Scottish Widows Knowledge Centre.

Disclosure: This is a paid partnership with Scottish Widows for the #TakingOnYourFutureTogether Campaign. Pensions are a long-term investment. The retirement benefits you receive from your pension plan will depend on a number of factors including the value of your plan when you decide to take your benefits which aren’t guaranteed and can go down as well as up. The value of your plan could fall below the amount(s) paid in.

Well written and so important people take out a pension as young as possible. Wish I had taken one out earlier.

I really need to look in to this more, this post was a great place to start and also that kick up the bum I needed to get me to find out more

I think it will help a lot of people.

I had never heard of Automatic Enrolment. A useful post. Thank you.

Never heard of this before but certainly a good idea

I think that it could be hard to save for the future, when most young people are already in debt one way or the other, has min wage does not pay enough to get out of debt let alone save some. if you are on benefits it must be even harder.

Hearing a lot about this in the news – certainly pays to save for retirement – need to make more aware especially low income earners

Very useful info, thanks for sharing this, it’s something I need to look into.

Great to encourage everyone to think about their financial future!

Cool

The pension news this week has prompted me to read your post again. Lots of info to consider.

great idea, but most live hand to mouth each month, in an ideal world would be great to have some spare to save. i do not even have enough NI contributions to qualify for full pension, raising kids, and now disabled unable to work, my future looks grim!

Great post – thank you

A really useful article, thank ypu

It certainly is a very good idea, thank you so much for sharing and providing with all of the information.

Interesting. (づ ̄ ³ ̄)づ

Thanks for this important info!

A useful post, but to be honest I don’t think any amount of saving will help young (and young-ish) people to retire with a healthy pension. My husband and I have already accepted that, bar a lottery win, we’re probably going to have to work until we die. Very depressing, but the economy is so broken I’m not sure it’s realistic to expect anything else.

A very useful and sensible article. I am lucky as I already receive my pension but do feel guilty that others, younger than me, have to wait so long for theirs.

wonderful review, loved reading it

A lot of people these days dont want to contribute because it isnt happening in the here and now but i think its a great idea and investment!

Really useful article

Unfortunately I suspect the reason women are not saving as much as men is that most women earn less than men, so have less discretionary income that could be put towards a pension.

This is something I have been thinking a lot about recently so this article was very useful for me, thank you.

Great article l think its so hard for people to talk about money and their financial future but its always nice to have options for an informed choice!

I’ve never heard of this before, thanks for the information!

I have actually started saving…. not for retirement though for a holiday I’m 40 and have never been abroad I would love to go with my partner and 2 youngest children

Brilliant

I think it is so important to make sure you have a good pension fund. Retirement may seem a long way away but it creeps up very quickly!

Interesting article

It’s actually quite frightening just how much you need to put away monthly to get a decent pension and unfortunately, impossible for many. Definitely needs more awareness, possibly starting in school.

Wish I had paid a bit more in tok my pension pot in earlier years. I can barely afford the minimum contribution now I have the kids.

Its one of those things you keep meaning to do but never get round to it but l definitely do need to look into it and get it sorted for the future!

At that age there was no way I could save I had 2 young children and was separated

It’s so hard to save these days. We all tend to live for the moment but with state pension age being pushed further and further back not having your own pension scheme set up could mean working well into old age.

I am thankful I paid into a pension scheme when I was young as I then thought I would get my state pension at 60 but now it is 67. Just 2 more years till my preserved pension pays out – I would hate to have to wait 9 more years to retire.

I’d never heard of this before! Thanks for the information!

Informative article thanks very much

Sounds a good idea

Great post I will reread it later.

This is great information. I wish I started saving earlier.

Have commented on here a few times but it’s a good article and great if it can help someone

fab read, wish I had taken mine out earlier

This is a really interesting and helpful article

What a very interesting read. I find it very hard to save money

I have 3 pensions but currently not paying into one so I need to get organised and sort one out x

I’m trying at the moment to save for a holiday I think its important also to create memories , to save but also enjoy life

Very interesting. I have life insurance but never thought of a pension, something to look into!

Very informative more people should know about their future financial arrangements and start contributing to a pension as soon as they can

I really wish I had taken a pension out when I was younger, to be honest I don’t have one or have ever had one. I am self employed so I have no idea how to go about that either xx

Auto-enrolment is a no brainer. You never see the money and then when you suddenly hit old age there’ll be something there.

Really good & informative.More people should save for the future.

Thank you for this info. It can seem silly to be paying for your pension when you’re so young but our older selves will thank us for it!

Some good information for women

oh a very interesting read

great red really makes you think, future can be scary